Patria Group’s Interim Report for 1 January – 31 March 2025

Patria’s net sales and operating profit grew in the first quarter, success in vehicle programmes continues.

| Key figures | 1-3/2025 | 1-3/2024 | Change | 2024 |

| New orders, EUR million | 303.5 | 625.4 | -51.5% | 1,258.2 |

| Order stock, EUR million | 2,502.6 | 2,394.7 | +4.5% | 2,375.5 |

| Net sales, EUR million | 189.2 | 172.1 | +9.9% | 825.7 |

| Operating profit, EUR million | 7.9 | 5.2 | +53.2% | 81.8 |

| Operating profit, % | 4.2% | 3.0% | 9.9% | |

| Income before taxes, EUR million | 4.8 | 3.4 | 41.1% | 70.8 |

| Equity ratio, % | 33.1 | 40.4 | 33.9 | |

| Gearing, % | 109.0 | 78.1 | 104.3 | |

| Return on equity, % | 19.3 | 18.4 | 19.7 | |

| Return on capital employed, % | 12.6 | 13.8 | 13.0 | |

| Personnel, end of period (FTE) | 3,684 | 3,464 | 3,662 |

The first quarter of 2025

Patria’s net sales increased by 10% to EUR 189,2 million in the first quarter 2025 compared to the comparison period in 2024 and the growth was primarily driven by armoured vehicles. Group operating profit (EBIT) developed positively and rose to EUR 7.9 million. Patria’s order stock reached EUR 2.5 billion at the end of March 2025.

There is strong demand for Patria's products and services, and the defence technology market is growing. The company has increased investments to respond to growing demand and to develop its offerings for enhanced customer value and competitiveness.

A significant portion of operational efforts has been directed toward increasing production capacity to meet the growing demand for armoured vehicles and improving the productivity of operations. In March, Patria announced plans to change its operating model to focus on three key business areas. Change negotiations concerning all units in Finland began on 17 March 2025 and ended on 22 April 2025. On 26 March 2025, a EUR 40 million investment was announced to enhance and expand armoured vehicle production in Hämeenlinna.

Millog and Nammo had a clear positive impact on net sales and operating profit growth in the first quarter.

Key events during the quarter

- In January, Patria signed an agreement with Airways Aviation Group on them acquiring the entire share capital of its subsidiary Patria Pilot Training Oy. As of 1 February, 2025, all employees, operations and ongoing training courses of Patria’s Pilot Training were transferred to Airways Aviation.

- In January, Patria announced its plan to acquire Belgium-based digital defence platform provider ILIAS Solutions. With the acquisition of the number-one digital defence platform for fleet management, Patria enhances its standard of digital services. The related authority approval process is in progress.

- In February, Slovenia and Finland signed Letter of Intent on support for the procurement of 8x8 Armoured Modular Vehicles from Patria.

- Several steps were taken in Common Armoured Vehicle System (CAVS) programme during the quarter: Patria and Babcock agreed partnership on 6x6 vehicle for the UK armed forces and Germany took final step to full member of CAVS programme as well as Germany and Patria signed work package for CAVS Patria 6x6 programme-related mortar variants development.

Event after the period

- Denmark joined the CAVS programme by signing the Technical Arrangement on 1 April, 2025.

Outlook

Demand for Patria’s products and services continues to grow. Strong net sales growth is expected in 2025, supported by an increased order stock. Most of the growth is expected to be generated by the armoured vehicle business. The outlook for the other business areas is also positive.

The start of the serial production for certain 8x8 armoured vehicle projects has been slower than planned, which may have an impact on the net sales for the year.

The impact of the geopolitical situation and general economic uncertainty on long-term development in the operating environment is difficult to evaluate. These factors could potentially have significant direct and indirect impacts on the demand and Patria’s operations.

Further information:

Päivi Lindqvist, Chief Financial Officer, Patria, [email protected]

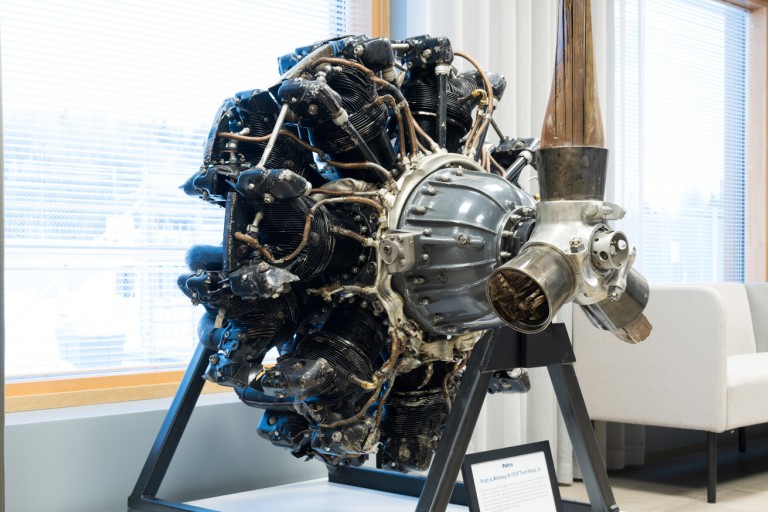

Patria is a modern and international defence and technology company with over 100 years of experience. Through our top-notch experts and Through life capability, Protected mobility & defence systems and Battlefield & critical systems products and services, we ensure reliable operations for our customers and serve as a partner in critical functions on land, sea and air - when if is not an option. Patria has offices in Finland, Sweden, Norway, Belgium, the Netherlands, Estonia, Latvia, and Japan.

Patria is owned by the State of Finland (50.1%) and Norwegian Kongsberg Defence & Aerospace AS (49.9%). Patria owns 50% of Nammo, and together these three companies form a leading Nordic defence partnership.

www.patriagroup.com