Patria Group’s Interim Report for 1 January - 30 June 2025

Patria’s net sales and operating profit grew in the first half year, the demand in vehicle programmes remains strong

| Key figures | 1-6/2025 | 1-6/2024 | Change | 2024 |

| New orders, EUR million | 453.5 | 737.9 | -38.5% | 1,258.2 |

| Order stock, EUR million | 2,424.4 | 2,302.0 | +5.3% | 2,375.5 |

| Net sales, EUR million | 421.0 | 375.9 | +12.0% | 825.7 |

| Operating profit, EUR million | 29.3 | 21.7 | +35.0% | 81.8 |

| Operating profit, % | 7.0% | 5.8% | 9.9% | |

| Income before taxes, EUR million | 22.4 | 17.3 | +29.5% | 70.8 |

| Equity ratio, % | 29.8 | 33.0 | 33.9 | |

| Gearing, % | 152.6 | 118.6 | 104.3 | |

| Return on equity, % | 21.3 | 19.4 | 19.7 | |

| Return on capital employed, % | 12.0 | 13.1 | 13.0 | |

| Personnel, end of period (FTE) | 3,928 | 3,613 | 3,662 |

The first half year 2025

Patria’s net sales in the first half of 2025 were EUR 421.0 million, representing a 12.0% increase compared to the same period in 2024. Net sales grew across all of Patria’s business areas during the first half of the year. The Group’s operating profit (EBIT) also developed positively, rising to EUR 29.3 million.

At the end of the first half of 2025, Patria’s order stock stood at EUR 2.4 billion. The timing of major orders is different in 2025 compared to 2024. The comparison period included an order for 321 vehicles for Sweden under Common Armoured Vehicle System (CAVS) programme, valued at approximately EUR 470 million whereas in the first half of 2025 no new significant vehicle orders were recorded.

Interest in Patria’s products and services has further increased as defence budgets have grown. The company has increased investments to respond to growing demand and to develop its offerings for enhanced customer value and competitiveness.

A significant portion of operational efforts have been directed toward increasing production capacity to meet the growing demand for armoured vehicles and improving the productivity of operations. Patria’s new operating model, based on three key business areas, came into effect on 1 June, 2025.

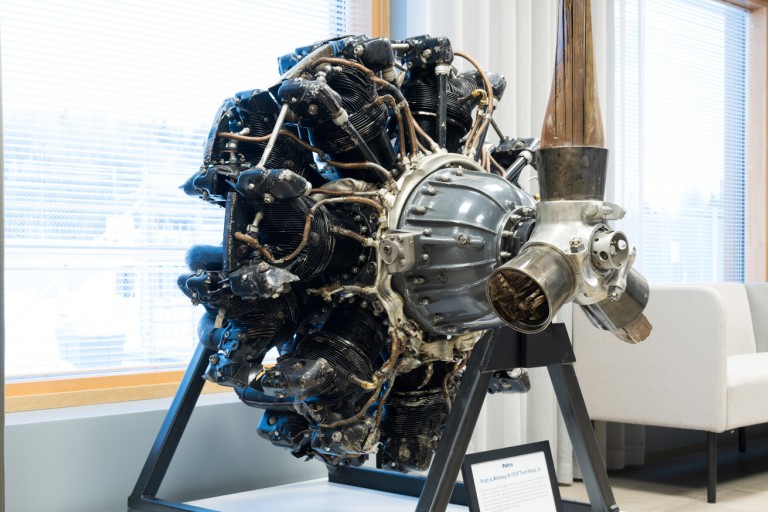

Patria hosted the opening ceremony of the F-35 production building on 13 June, 2025 at Patria’s Halli facility in Jämsä, Finland. The new production facility, which will be completed during the autumn of 2025, is part of the industrial cooperation of Finland’s F-35 fighter programme.

Millog had a positive impact on the Group’s net sales and operating profit, while Nammo had a clearly positive impact on operating profit during the first half of 2025.

Key events during the second quarter

- Denmark joined the CAVS programme by signing the Technical Arrangement on 1 April, 2025. Denmark joins the programme now as the fifth nation after Finland, Latvia, Sweden and Germany.

- In May, it was announced that an industry consortium for the new joint Artificial Intelligence Warfare Adaptive Swarm Platform (AI-WASP) programme, which will develop a new generation, scalable and cognitive (AI-controlled) multifunctional software defined converged aperture and transceiver (AIMA). The programme received EUR 45 million in support from the European Commission.

- On 31 May, Patria announced the launch of a strategic partnership with the Spanish company GDELS-Santa Bárbara Sistemas (GDELS) concerning the assembly and maintenance of ASCOD Infantry Fighting Vehicles (IFVs). Patria’s Valmiera production facility in Latvia will be responsible for the assembly and maintenance, with production of the first vehicles expected to begin in June 2026.

- On 30 June, Patria signed an agreement to sell its 60% stake in Milworks OU, an Estonian provider of lifecycle management services, to Mootor Grupp. The divestment is in line with Patria’s strategy to focus its MRO (Maintenance, Repair and Overhaul) operations in the Baltic region to its growing Valmiera site in Latvia. Milworks employs 15 people in total, and the transaction is expected to be completed on 31 July, 2025.

Outlook

Demand for Patria’s products and services continues to grow. Growth is further boosted by the increase in defence budgets in European NATO countries in accordance with the decisions at the NATO Summit 2025 in the Hague.

Strong net sales growth is expected in 2025, supported by an increased order stock. Most of the growth is expected to be generated by the armoured vehicle business. The outlook for the other business areas is also positive.

The ramp-up of the armoured vehicle production has been more time-consuming than anticipated. The operations will have full focus on securing customer deliveries and speeding-up capacity increase to meet the accelerating growth in demand.

The impact of the geopolitical situation and general economic uncertainty on long-term development in the operating environment is difficult to evaluate. These factors could potentially have significant direct and indirect impacts on the demand and Patria’s operations.

Further information:

Päivi Lindqvist, Chief Financial Officer, Patria, [email protected]

Patria is a modern and international defence and technology company with over 100 years of experience. Through our top-notch experts and Protected Mobility, Defence and Weapon Systems and Sustainment Solutions business areas, we ensure reliable operations for our customers and serve as a partner in critical functions on land, sea and air - when if is not an option. Patria has offices in Finland, Sweden, Norway, Belgium, the Netherlands, Germany, Estonia, Latvia, and Japan.

Patria is owned by the State of Finland (50.1%) and Norwegian Kongsberg Defence & Aerospace AS (49.9%). Patria owns 50% of Nammo, and together these three companies form a leading Nordic defence partnership.

www.patriagroup.com