Patria adheres strictly to all relevant accounting and financial reporting regulations. Financial statements are prepared in accordance with IFRS standards. All financial transactions require approval in line with Patria's governance procedures and must be recorded appropriately. These entry and reporting obligations are compulsory and are regularly monitored through annual audits and robust internal controls. Patria does not tolerate the falsification or manipulation of financial or other documents, nor the provision of misleading information under any circumstances.

Profitability is the foundation of all business operations and the foundation of responsibility.

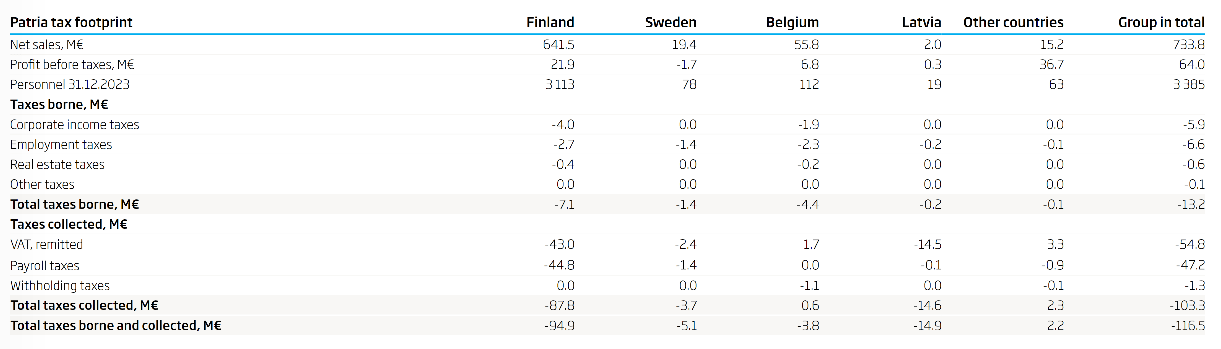

Patria Group observes the tax laws and regulations applicable in each jurisdiction where it operates. In instances where tax legislation is ambiguous, the company applies principles of prudence, conservatism, and transparency.

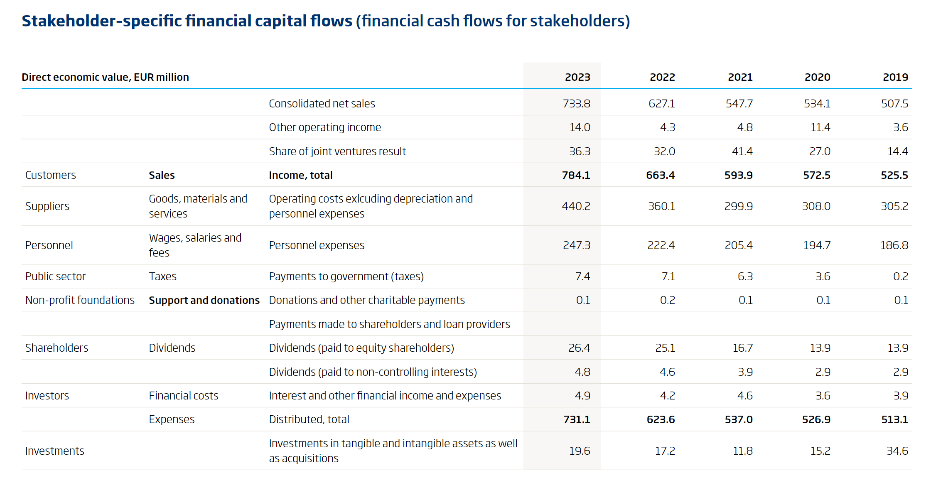

Profitability is fundamental to Patria’s business operations and underpins its commitment to responsible conduct. The company strives to operate efficiently and profitably, while recognising its responsibilities as a partner of the Finnish Defence Forces and the broader societal impact of its activities. In addition to financial performance, key aspects of Patria’s financial responsibility include adherence to anti-corruption measures, prevention of money laundering, and compliance with competition regulations.

Patria pursues sustainable, long-term growth by investing in the development of customer relationships, services, and expertise, thereby providing dependable products and services. Effective optimisation of financial resources is critical for ensuring sustained, profitable growth. The company maintains professional, long-term engagements with its suppliers and subcontractors, and continually seeks cost-effective improvements through collaboration.

Dividends are distributed to shareholders as determined by the Annual General Meeting, based on profitability. Charitable donations are allocated to centrally selected organisations in a transparent manner.

Patria's tax strategy emphasises full transparency, with taxes paid in the countries where business activities are conducted. The company does not utilise tax havens to reduce tax liabilities. The tax strategy is designed to support sound business decisions and ensure proper execution from a taxation standpoint, always starting from compliance with local legislation and fulfilling all reporting requirements.

Patria has a zero-tolerance policy towards money laundering. Its financial reporting remains accurate, reliable, and current at all times.

Stakeholder-specific capital flows

Tax footprint